Introduction

It is one of the most crucial profitability metrics. You can use it as a benchmark to measure how much earnings or profit a company generates per outstanding share of common stock. This article will discuss EPS in greater details, providing background and explanations about its calculation, significance, and methodology for interpreting it effectively.

What is Earnings Per Share (EPS)?

It is a type of financial ratio that computes the amount of profit a company generates per share. To calculate this ratio, divide the company’s net income by the total number of outstanding common stock shares.

EPS = Net Income / Average Outstanding Shares

Significance of EPS

EPS is a valuable tool for investors because it allows them to:

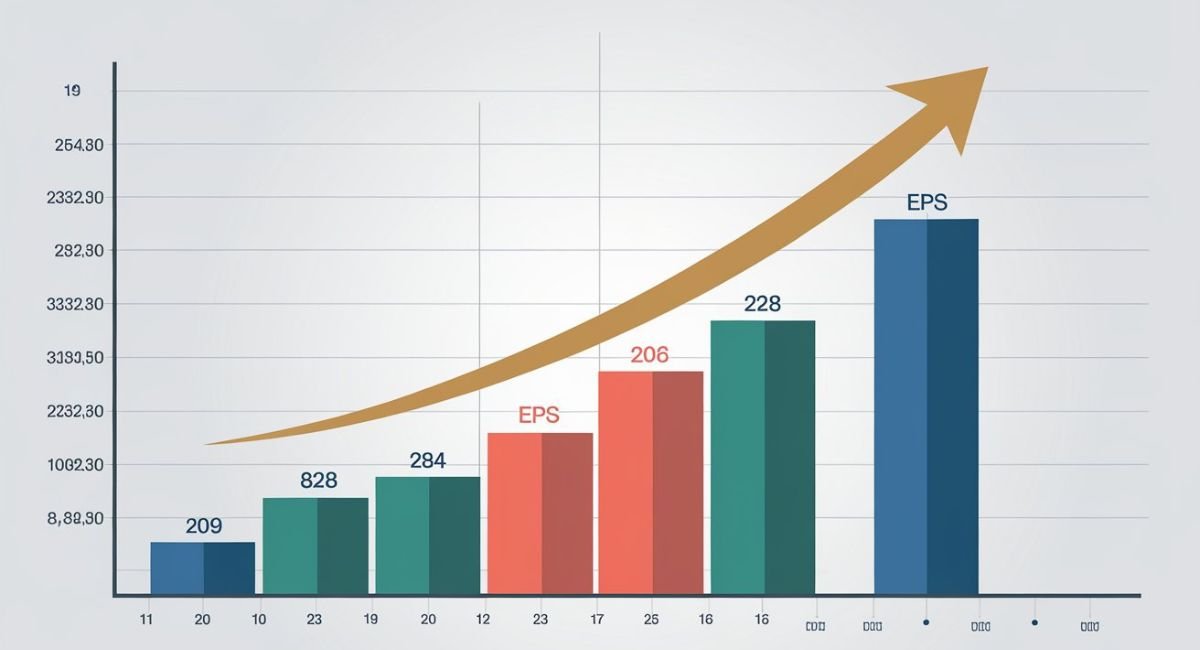

- Review growth: Increasing upward trend in for consecutive years indicates that the profit of a company has grown.

- Review investment opportunity: Numerous investors identify companies that are undervalued and have future growth prospects.

- Review management efficiency: A greater value means that a company is really making profits from its operations.

- Net income: The company earns this net amount after subtracting all expenses and paying taxes.

- Average outstanding shares: This represents the average number of common shares outstanding for the period considered.

How to Calculate EPS

Once you’ve obtained these figures, what you do is divide the net income by the average outstanding shares to obtain.

Generally, a high EPS normally indicates that the company is more profitable. However, you have to consider many other things when interpreting, including.

Once you have these figures, simply divide the net income by the average outstanding shares to determine.

Interpreting EPS

A higher it generally indicates a more profitable company. However, it’s important to consider other factors when interpreting, such as:

- Industry Standards: It needs to be aligned with other firms in the same industry

- Growth Trends: It has always gone up with time. This should provide a positive signal

- Quality of Earnings: once again, you need to examine the quality of earnings of the firm as several factors may have artificially inflated or depressed.

There are two main types of EPS:

- Basic: This is calculated as shown below:.

- Diluted: Refers to a measure, which considers the probable earnings of the convertible securities like stock options or warrants into a denominator. In this way, Diluted it is a more conservative profitability measure for a company.

FAQs

What is a good EPS ratio?

A good EPS ratio depends on the industry and the overall market conditions. Generally, people consider a higher ratio better.

How can I improve EPS?

Companies can improve their by increasing revenue, reducing expenses, or repurchasing shares.

Can EPS be negative?

Yes, it can be negative if a company incurs a loss.

What are the limitations of EPS?

It can be influenced by factors such as accounting methods, one-time gains or losses, and changes in the number of outstanding shares.

Should I rely solely on EPS for investment decisions?

No, It should be considered in conjunction with other financial metrics and factors to make informed investment decisions.

Conclusion

It is a very valuable tool in the knowledge of profitability of companies. 1 Calculating and interpreting it can make better ideas for investors, knowing where to invest. However, analyzing EPS effectively requires considering other factors and combining them with additional financial metrics for a complete picture.